tax sheltered annuity vs 403b

Guaranteed income starting immediately. Equitable Financial Life Insurance Company NY NY.

How To Transfer A Tax Sheltered Annuity 403 B To A Traditional Ira

Sometimes a TDA plan is also.

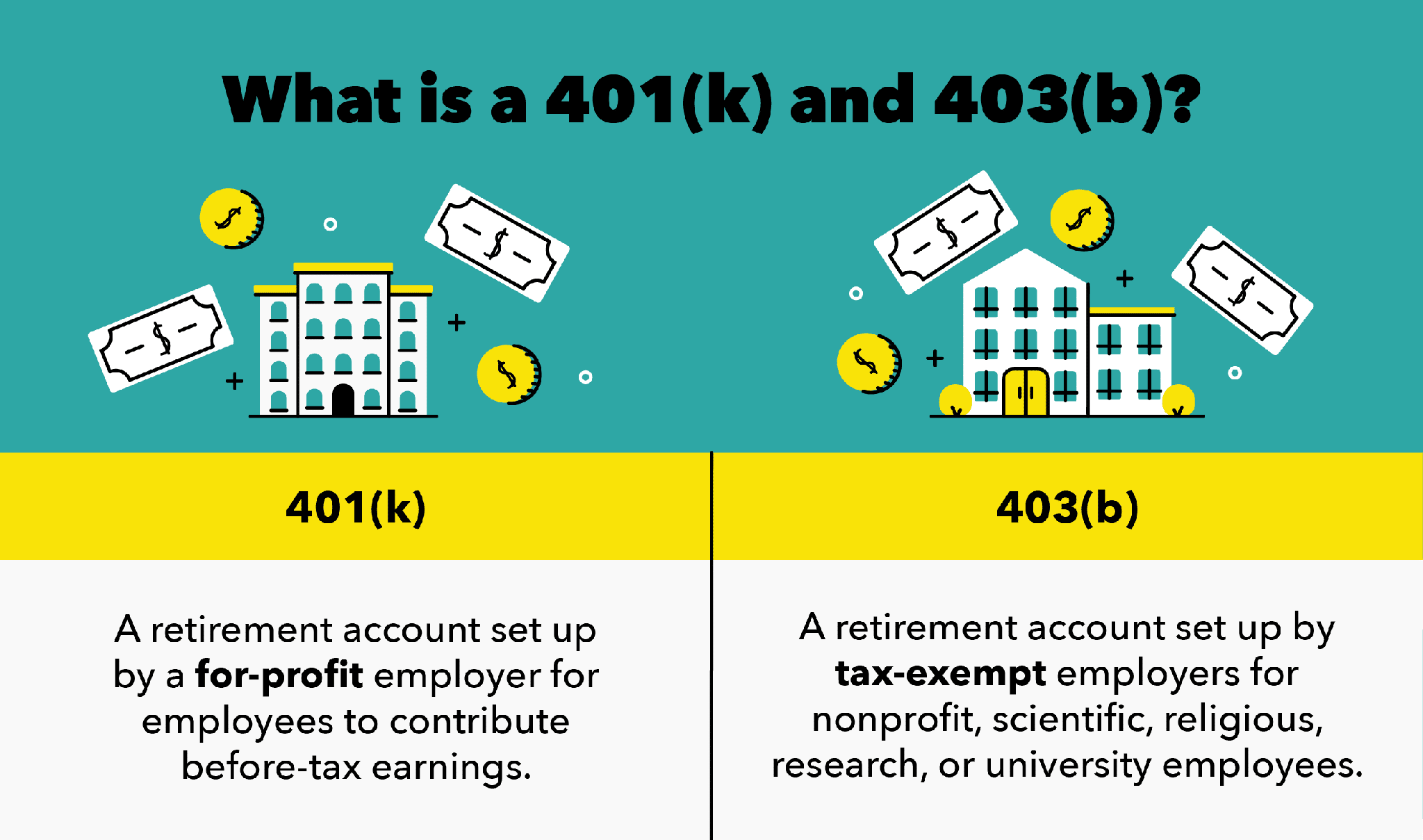

. Many people get 401 k retirement plans from their employer but if you. A 403 b plan tax-sheltered annuity plan or TSA is a retirement plan offered by public schools and certain charities. In the US one specific tax-sheltered annuity is the 403b plan.

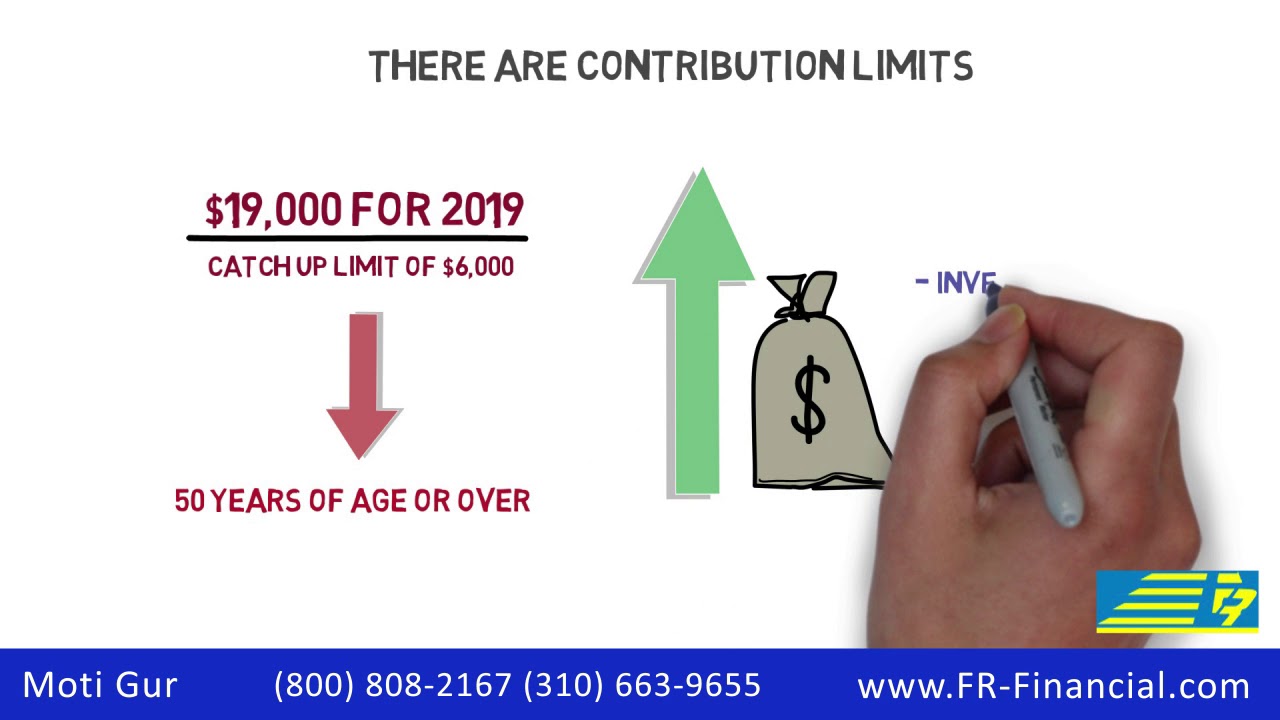

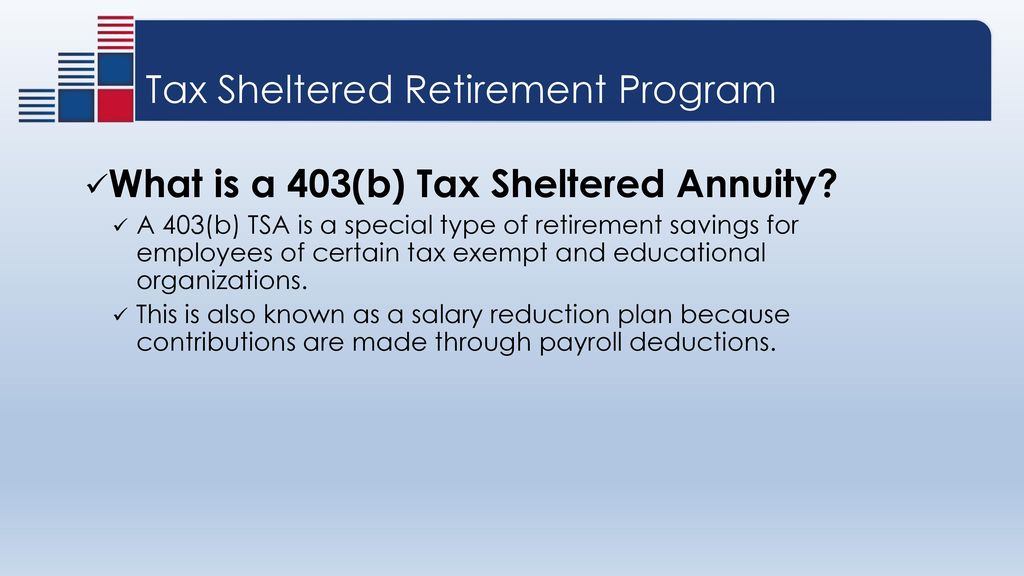

TSA as Defined by IRS. A 403b is also known as a tax-sheltered annuity TSA. A 403b plan is also another name for a tax-sheltered annuity plan and the features of a 403b plan are comparable to those found in a 401k plan.

Ad Learn How to Prepare for Retirement. Like the 401k 403b plans are a type of defined-contribution plan that allows participants to shelter money on a tax-deferred basis for retirement. The Internal Revenue Code 403B Tax-Sheltered Annuity Plan is a retirement plan offered by public schools colleges and universities and 501 c 3.

Understanding a Tax-Sheltered Annuity. Ad Learn How a 403b Can Help Prepare You for a Comfortable Retirement Online Today. Lets Face the Future Together.

A tax-deferred annuity TDA plan is a type of retirement plan designed to complement your employers base retirement plan. An employee may elect to transfer funds from an existing 403b plan to a new 403b plan according to the plans guidelines and IRS regulations. What Is a 403b.

Nonprofits and public education institutions can establish tax-sheltered annuity plans often known as 403 b plans. Retirement Income and the Retirement Options Available to You With American Funds. A 403b plan is also known as a tax-sheltered annuity or TSA plan.

Lets Face the Future Together. Ad Learn How a 403b Can Help Prepare You for a Comfortable Retirement Online Today. A Tax Sheltered Annuity TSA is a pension plan for employees of nonprofit organizations as specified by the IRS under sections 501 c 3 and 403 b of the Internal Revenue Code.

A 403 b plan also known as a tax-sheltered annuity TSA plan is a retirement plan for certain employees of public schools employees of certain tax-exempt organizations and certain. Ad Compare income annuity quotes from across the market quickly and for free. 403b plans are similar to 401ks in that they allow employees at eligible.

Ad Safe Secure Compound Growth And The Highest Rates. 457b Tax Sheltered Annuity. Ad Learn some startling facts about this often complex investment product.

When these plans were. Tax Sheltered Annuity 403b Deferred Compensation 457 General Description A retirement. These plans tend to be offered by public schools and some nonprofits.

The IRS will accept applications through April 30 2015. The regulations package reaches out beyond. Differences in Plan Taxes.

What Are 403 b Annuities. So while the name tax-sheltered annuity lingers its a bit of a misnomer. A 403 b plan often referred to as a tax-sheltered annuity account TSA is a retirement plan offered exclusively by public schools and certain charities.

They enable participants to invest pre. A 403b plan sometimes called a tax-sheltered annuity plan is a type of retirement plan available to public school employees certain ministers and employees of. Its like a 401k but for public and non-profit institutions rather than private companies.

What is a tax-deferred annuity plan. Overview of the 403b Final Regulations On July 23 2007 the first comprehensive regulations in 43 years were issued published July 26 2007. When the 403b was invented in 1958 it was known as a tax-sheltered annuity.

A 403b plan also known as a tax-sheltered annuity plan is a retirement account available to certain employees including public school teachers and nonprofit workers. Get Your Free Report Now. As a refresher an IRS-approved tax-sheltered annuity also known as a TSA or 403b is a retirement plan offered by public schools and some nonprofit organizations with.

Sets forth the procedures of the IRS for issuing opinion and advisory letters for IRC section 403 b pre-approved plans. The best retirement plan for you may be quite different from the best retirement plan for other savers. 2022 Plan Comparison.

This plan provides employees of certain nonprofit and public. Its similar to a 401 k plan maintained by a for-profit entity. Ad Its Time For A New Conversation About Your Retirement Priorities.

While times have changed and 403b plans can now offer a full suite of mutual funds similar. How Much Income Does An Annuity Pay. A 403 b plan is very similar to 401.

Tax Sheltered Annuity 403b Deferred Compensation 457. Equitable Financial Life Insurance Company NY NY. Discover Retirement Planning Tools Information on.

Ad Learn More about How Annuities Work from Fidelity. Income Annuity Quotes From Top-Rated Insurers. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying.

Taxsheltered Annuity Plans Also Known As 403b Plans

Withdrawing Money From An Annuity How To Avoid Penalties

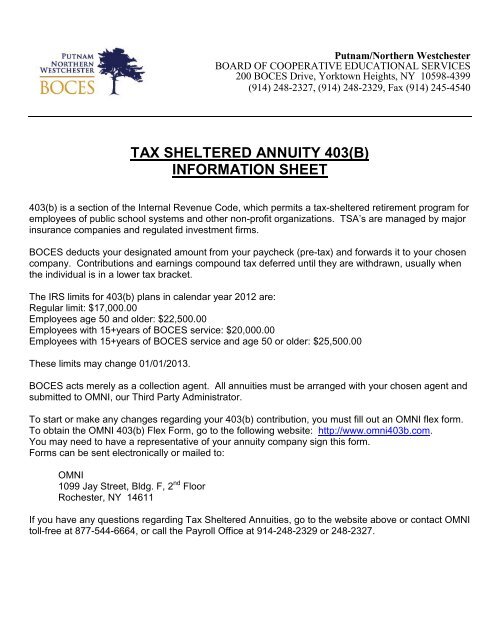

Tax Sheltered Annuity 403 B Information Sheet Boces

403b Tsa Annuity For Public Employees National Educational Services

Tax Sheltered Annuity Faqs Employee Benefits

403 B Tax Sheltered Annuity Plans Tsa S Longmeadow Ma

![]()

403 B Tsa Tax Sheltered Annuity Eecu Member Investment Services

Irs Publication 571 How To Plan Annuity Publication

/annuity-c64facb507ac4b1c99b1ac5ba9bac1a8.jpg)

Tax Sheltered Annuity Definition

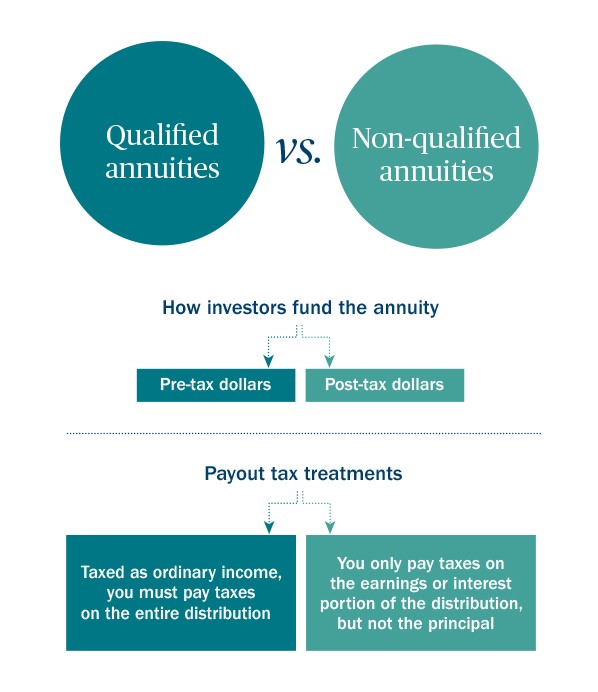

Annuity Taxation How Various Annuities Are Taxed

Massmutual What S In A Name A Retirement Plan Comparison

403b Tax Shelter Annuity Plan Basics Youtube

Annuity Taxation How Various Annuities Are Taxed

403 B Vs 401 K Which Is The Better Plan Pros And Cons

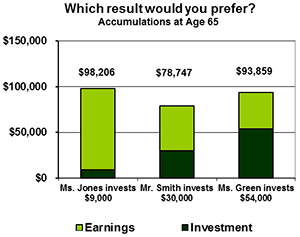

The Importance Of Saving For Your Retirement Ppt Download

Withdrawing Money From An Annuity How To Avoid Penalties